A unique kind of loan known as a “car title loan” exchanges cash for the title of your car as security. Note that the car itself is not the collateral. This is wonderful news because it enables you to keep using your car while paying back your title loan.

Lenders frequently don’t examine your credit, which makes car title loans a wonderful option. Additionally, most applications are processed quickly, and many clients receive their funds within one working day.

It’s a secured loan that enables borrowers to use their car as security. Since your car serves as collateral for the loan, if you default on the loan, the lender may seize your car. Since title loans typically have low restrictions and are short-term, high-interest loans, it’s possible to qualify even with bad credit. Credit histories and scores are frequently not taken into account at all.

- USTitleLoans-https://ustitleloans.com/

- LoanMart-https://www.800loanmart.com/

- TitleMax-https://www.titlemax.com/title-loans/

- Speedy Cash-https://www.speedycash.com/title-loans/

- LendingTree-https://www.lendingtree.com/

USTitleLoans

Title loans site as USTitleLoans is a reliable platform that links many lenders and borrowers. In essence, it serves as a marketplace for loans, allowing borrowers to choose from a variety of offers from lenders and have their loan amount credited on the same day.

USTitleLoans provides some of the greatest auto title loan offers available. A lender with a high approval rate will be found for borrowers who submit an online loan request.

Even loan beginners may easily browse the platform’s user-friendly, responsive interface. You are guaranteed bank-level confidentiality by USTitleLoans. They even offered a service that can help you find the suitable title loans near you in any states. Check here and get the title loan in Nevada.

You may obtain a car title loan online from USTitleLoans in a matter of minutes because they make sure the application process is simple and their lenders make judgments on approval as quickly.

Furthermore, USTitleLoans acts quickly to deposit the same-day loan amount into your bank account. The application form collects data to match you with the finest vehicle title loan provider, unlike dishonest firms that sell client data to survey sites.

Pros

- The willingness of lenders to renegotiate deadlines

- Alternatives to automobile title loans, such as rapid payday loans, are available to users.

- Poor credit is regarded as

- Your credit score will not be impacted by a loan.

Cons

- Only current users can access some of its features.

Visit their website and secure your future

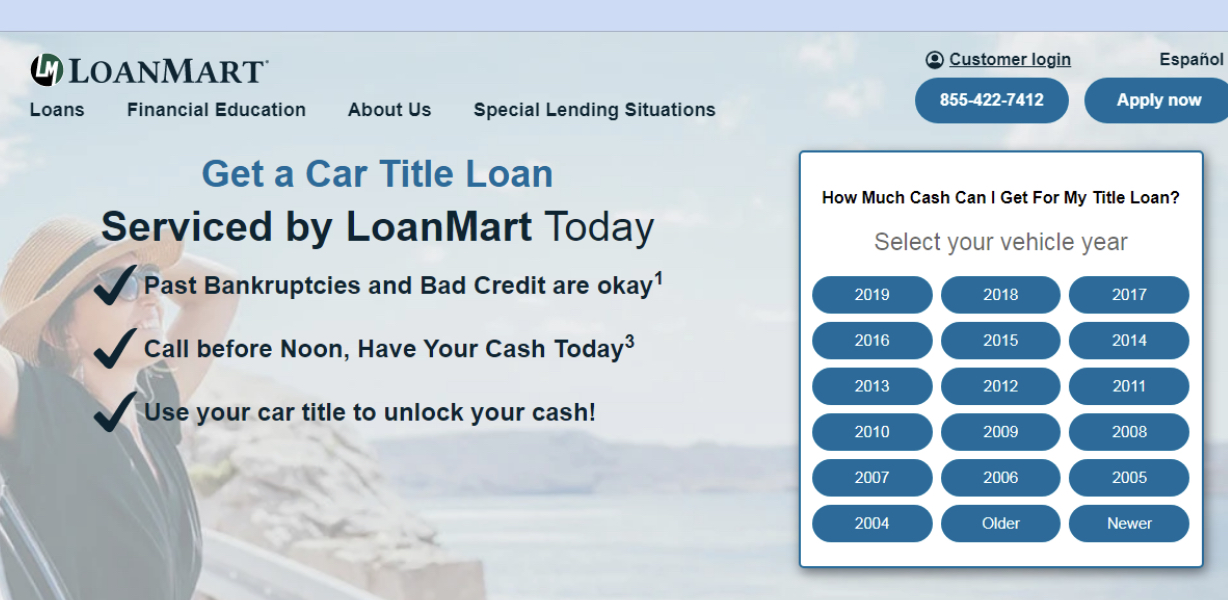

LoanMart

LoanMart, an online direct lender, offers title loan rates lower than most firms and is one of the greatest financial institutions.

We included LoanMart in our list of providers of auto title loans due to its excellent Google (4.5) and Trustpilot (4.7) customer satisfaction ratings. LoanMart’s easy application and same-day or next-business-day funding have kept customers delighted for 20 years.

Pros

- No early payment fees

- Offered in 29 states

- Customer service agents are renowned for their politeness

- Offers consumers favorable title loan terms that other creditors won’t accept

- High levels of support

Cons

- Offers exclusively for in-person, direct deposit, mail, and money transfer as payment methods

Click here to land on their website

TitleMax

TitleMax, one of the largest US vehicle title lenders, also offers motorbike title loans. In addition, TitleMax provides personal loans, title pawns for motorcycles, and auto title loans.

They offer excellent services. It may be simpler than you imagine to get a loan approved, and the approval procedure is simple and quick. The process can be completed online or over the phone without going to a lending store, which is the best part.

Pros

- Motorcycle title loans are available in more than 1,000 physical locations.

- Available same-day funding Customer-centric policies

Cons

- The $2,600 minimum loan amount is a tad steep.

Visit their website for exciting services

Speedy Cash

The lending and connection services provided by Speedy Cash are among the most respected in the industry. On TrustPilot, it has a rating of 4.5 out of 5. Since the company’s founding in 1997, it has offered prospective borrowers of auto title loans some of the greatest terms.

Speedy Cash, marketed as Rapid Cash in Washington, Nevada, and Oregon, seeks for customer intimacy. As a result, it provides services in-person, online, and over the phone.

Pros

- Electronic payments

- Several funding alternatives

- Flexible choices for repayment

- Simple and practical to use

- excellent client service

Cons

- Possibly levies an origination fee

LendingTree

LendingTree is a fantastic online choice for people with severely low credit, and it has the size and standing of a market leader. LendingTree is a leading short-term lender with over 10 billion in loans.

The fact that LendingTree lends to people with really bad credit sets it apart from other prominent companies like Prosper and LendingClub. People with credit ratings as low as 500 have loan alternatives available to them through LendingTree.

Pros

- LendingTree, one of the biggest online loan providers, is a name you can rely on.

- APRs are between 3.99% and 35.99%.

- Low credit score standards.

- One day’s worth of approbation.

Cons

- Some applicants with incredibly poor credit won’t be accepted.

Visit their website and grab your title loan

How to choose the best Car Title Loans site?

Individuals in need of money can get loans from a variety of businesses or financial institutions. By comparing various lenders, borrowers can obtain affordable rates and steer clear of any hazards.

Trust and Reputation

It is crucial to investigate a title loan company’s standing, reliability, and level of expertise. Borrowers should generally have faith in businesses that have a solid reputation.

View Client Reviews

Genuine testimonials are frequently published by shrewd, trustworthy lenders to promote their money-lending businesses. Visit money lending organizations’ websites to view customer testimonials.

Conclusion

Short-term loans without a credit check are available through online title loans. As a result, they are a fantastic choice for anyone who requires rapid cash to handle an unexpected financial emergency. In this article, we’ve identified five of the best online brokers for title loans.